Swipe left or right to close the panel.

×

Tax Services In Malaysia

Best Review Based on Most Mentioned Phrase / Active User

Withholding Tax Services In Malaysia

5 times mentioned • Jason Lim • 27 February 2020

Withholding Tax Services In Malaysia

Tax Services In Malaysia

8 times mentioned • Jason Lim • 28 February 2020

Tax Services In Malaysia

|

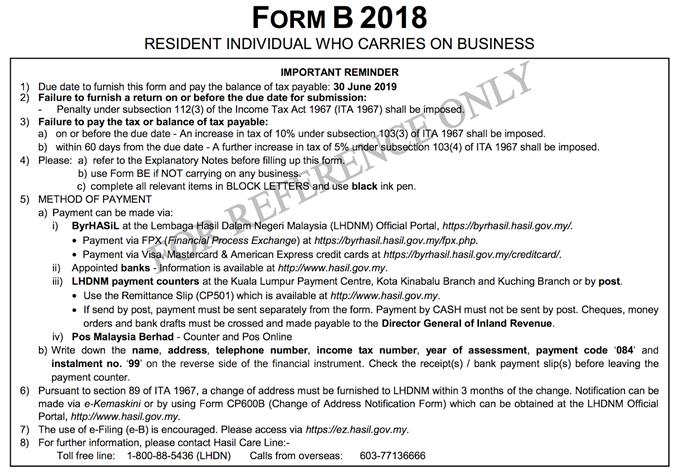

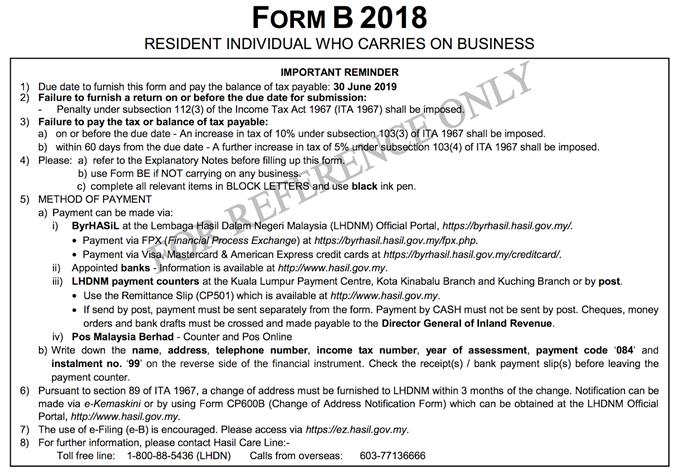

The above are starter guides that allows you to better understanding income tax payments in Malaysia. There is more to be discussed in the subject of tax. Perhaps, you are exploring possible methods to save on tax payments or enjoy tax benefits legally and thus, needing professional tax advice. If that is you, you may use the form displayed earlier on this page or our home page. We provide you easy access to tax agents by quickly referring you to experts that provide accounting, audit, and tax services in Malaysia.

|

|

Personal Tax Services

8 times mentioned • Jason Lim • 27 February 2020

Personal Tax Services

|

Personal Income Tax. Personal Tax Services in Malaysia. Every Malaysian resident is required by the law to pay taxes on both their Malaysian and outside sources of income. Anyone who has lived in Malaysia for 182 days or more in a calendar year is considered a resident and therefore liable to taxation. It is good to note that income tax in Malaysia is measurable and goes up to 25% based on one's total earnings. Residents can enjoy some level of tax reliefs while non-residents are entitled to pay tax only for the income earned within Malaysia.

|

|

Everyone can have their own blog websites now. People use Invaber to blog their life, post their wishlists, post their preferences, share with others on Google. You also can discover more on what you blog. Invaber is sponsored by Microsoft.

|

|

Join Invaber |

|

|

What is Invaber? |

|

Lastest Business

|

|