Swipe left or right to close the panel.

×

Top 10 Most Related Posts

Best Review Based on Most Mentioned Phrase / Active User

Withholding Tax Services In Malaysia

5 times mentioned • Jason Lim • 27 February 2020

Withholding Tax Services In Malaysia

Withholding Tax Services In Malaysia

5 times mentioned • Leo Tan • 27 February 2020

Withholding Tax Services In Malaysia

|

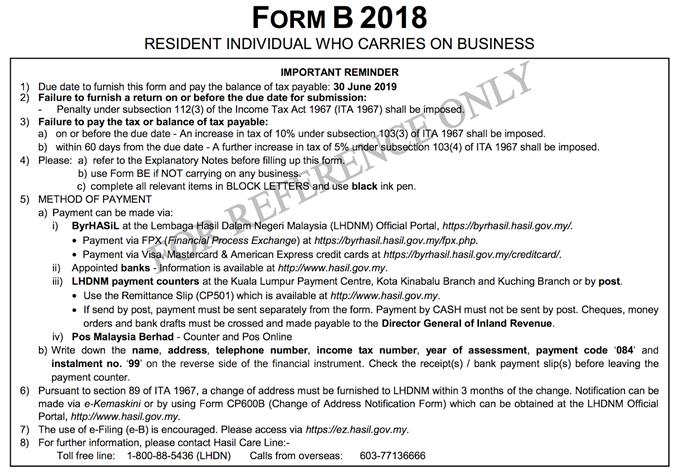

Taxation Services in Malaysia. Withholding Tax Services in Malaysia. In other words, withholding tax is a mechanism to collect income tax from certain groups of non-residents in Malaysia. Withholding tax will apply to certain payments such as royalty, interest, contract payments, and ‘special classes of income' made to non-residents.

|

|

Withholding Tax Services In Malaysia

5 times mentioned • Jason Lim • 27 February 2020

Withholding Tax Services In Malaysia

|

Taxation Services in Malaysia. Withholding Tax Services in Malaysia. Like many other countries, Malaysia imposes withholding taxes on certain payments to non-residents. Withholding tax is an amount that represents the tax portion of an income of a non-resident recipient, withheld by the payer in Malaysia, and it is paid directly to the IRBM.

|

|

Withholding Tax Services In Malaysia

5 times mentioned • Jason Lim • 27 February 2020

Withholding Tax Services In Malaysia

|

Taxation Services in Malaysia. Corporate Tax Compliance & Planning Services.

Goods and Services Tax (GST).

Malaysia Certificate of Residence Application (COR).

Personal Income Tax.

Withholding Tax Services in Malaysia.

E-Stamping.

Tax Clearance Letter Application.

Tax Investigation.

Transfer Pricing in Malaysia.

GST Health Check.

Sales and Services Tax (SST) Service in Malaysia.

|

|

Tax Services In Malaysia

8 times mentioned • Jason Lim • 28 February 2020

Tax Services In Malaysia

|

The above are starter guides that allows you to better understanding income tax payments in Malaysia. There is more to be discussed in the subject of tax. Perhaps, you are exploring possible methods to save on tax payments or enjoy tax benefits legally and thus, needing professional tax advice. If that is you, you may use the form displayed earlier on this page or our home page. We provide you easy access to tax agents by quickly referring you to experts that provide accounting, audit, and tax services in Malaysia.

|

|

Tax Services In Malaysia

8 times mentioned • Leo Tan • 28 February 2020

Tax Services In Malaysia

|

Tax Services. One of the highly chosen accounting firms with years of expertise in offering Tax Services in Malaysia; we have so far represented major of the corporations of Malaysia. We offer reliable tax services to corporate taxpayers as well as individuals looking for trusted tax solutions in Malaysia. We aim towards helping our clients at the best and keep them abreast with the tax laws and regulations.

|

|

Personal Tax Services

8 times mentioned • Jason Lim • 27 February 2020

Personal Tax Services

|

Personal Income Tax. Personal Tax Services in Malaysia. Every Malaysian resident is required by the law to pay taxes on both their Malaysian and outside sources of income. Anyone who has lived in Malaysia for 182 days or more in a calendar year is considered a resident and therefore liable to taxation. It is good to note that income tax in Malaysia is measurable and goes up to 25% based on one's total earnings. Residents can enjoy some level of tax reliefs while non-residents are entitled to pay tax only for the income earned within Malaysia.

|

|

Corporate Secretarial Services

11 times mentioned • Jason Lim • 28 February 2020

Corporate Secretarial Services

|

Tax Services. Tax Advisory Services. Because we help take your business further, faster, at all stages. BoardRoom is Asia-Pacific's leader in Corporate and Advisory Services including Regional Employee Plan Services, Regional Payroll Services, Corporate Secretarial Services, Share Registry Services, Accounting and Taxation Services, Payroll Outsourcing, and Human Resource Outsourcing. Get in touch with our tax experts today!

|

|

Tax Advisory Services

9 times mentioned • Jason Lim • 29 February 2020

Tax Advisory Services

|

Tax Services. At Emirates Chartered Accountants Group, we offer Tax Advisory Services in the UAE to our clients by providing them proper assistance & guidance on compliance of the provisions of the UAE Tax Laws. Our Tax Experts coupled with industry experience advice the businesses through all the tax challenges and support them for tax compliance and progress towards a sustainable Tax strategy.

|

|

Everyone can have their own blog websites now. People use Invaber to blog their life, post their wishlists, post their preferences, share with others on Google. You also can discover more on what you blog. Invaber is sponsored by Microsoft.

|

|

Join Invaber |

|

|

What is Invaber? |

|

Lastest Business

|

|