Swipe left or right to close the panel.

×

Top 10 Most Related Posts

Best Review Based on Most Mentioned Phrase / Active User

Countries Multi-stage Consumption Tax Sales

3 times mentioned • Leo Tan • 29 February 2020

Countries Multi-stage Consumption Tax Sales

|

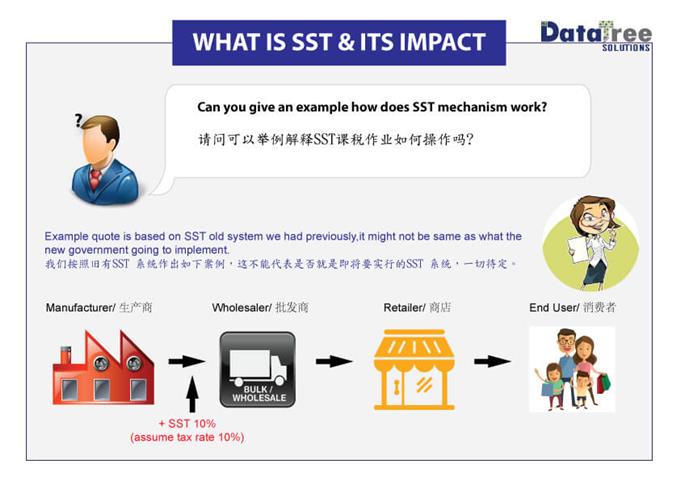

SST & Taxation Advisory. SST (Sales & Services Tax), which is also known as VAT or the value added tax in many countries is a multi-stage consumption tax on sales and services. Why do you have taxes? However, by using our Tax services we do provide tax consultation service often in order for our clients to plan and pay their personal tax and corporate effectively. We will assists our clients to minimized the tax that required by government to invest more of the money for their business in the future.

|

|

Countries Multi-stage Consumption Tax Sales

3 times mentioned • Jason Lim • 29 February 2020

Countries Multi-stage Consumption Tax Sales

|

SST & Taxation Advisory. SST (Sales & Services Tax), which is also known as VAT or the value added tax in many countries is a multi-stage consumption tax on sales and services. Why do you have taxes? Taxes is one of the main source for the federal, state and government revenues come from taxes either company or personal in order to provide a variety of user and service fees to pay for operating costs of the facilities such as transit systems and stadium.

|

|

Value Added Tax

8 times mentioned • Jason Lim • 27 February 2020

Value Added Tax

|

Taxation Services. Goods and Services Tax (GST). Introduced in April 2015, GST (Goods & Services Tax) is the value added tax (VAT) in Malaysia. GST Malaysia of 6% has been implemented to replace the consumption tax comprising the sales tax and the service tax (SST). It is levied on the supply of goods and services at each stage of the supply chain from the supplier up to the retail stage of the distribution. Furthermore, GST is expected to increase tax compliance and it is definitely easier to administer in view of its self-policing method.

|

|

Service Tax Imposed Consumers Using

3 times mentioned • Jason Lim • 28 February 2020

Service Tax Imposed Consumers Using

Service Tax Imposed Consumers Using

3 times mentioned • Jason Lim • 28 February 2020

Service Tax Imposed Consumers Using

|

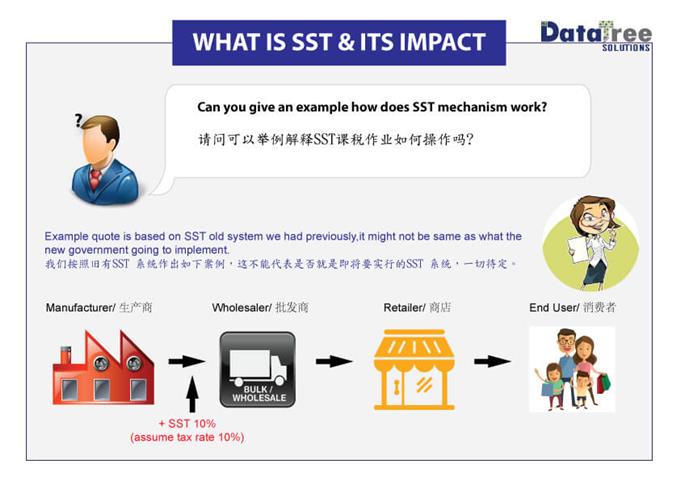

Difference between SST and GST. Sales and Services Tax (SST). The Sales Tax is only imposed on the manufacturer level whereas the Service Tax is imposed on consumers that are using tax services. SST rates are less transparent than the GST which had a standard 6% rate, the SST rates vary from 6 or 10%.

|

|

Value Added Tax

8 times mentioned • Leo Tan • 29 February 2020

Value Added Tax

|

Tax Services. VAT Consultants. UAE has entered into the world of Taxes very recently. While Excise Tax was introduced with effect from 1st October 2017, Value Added Tax (VAT) has just taken its course from 1st January 2018. VAT Registration is mandatory for companies and individuals doing businesses in the UAE, having an annual turnover of more than AED 375,000/-. UAE is going to implement VAT with effect from 1st January 2018.

|

|

Value Added Tax

8 times mentioned • Jaden Smith • 19 October 2018

Value Added Tax

|

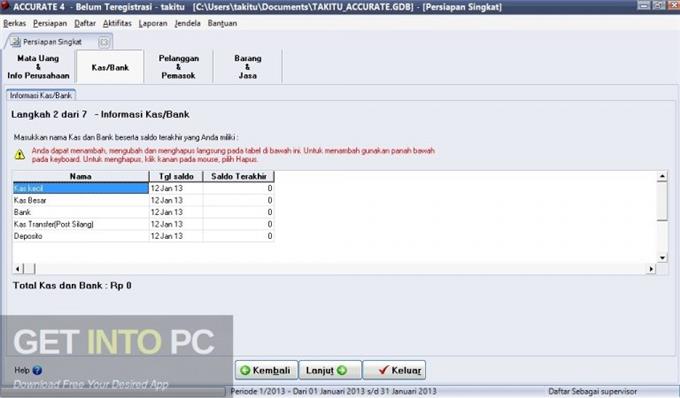

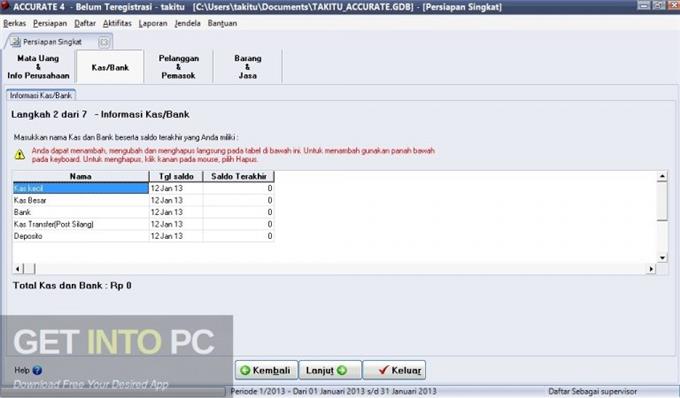

A very handy accounting software which comes in handy for all the accountant to deal with their financial matters efficiently. Integrated with Account Payable module, General Ledger, Account Receivable and Inventory. Got Value Added Tax (VAT) for Account Payable module. Got impressive templates in every form with a very user friendly template designer.

|

|

Value Added Tax

8 times mentioned • Jaden Smith • 19 October 2018

Value Added Tax

|

Accurate Accounting Enterprise 4 Overview. Accurate Accounting Enterprise 4 is a very handy accounting software which comes in handy for all the accountant to deal with their financial matters efficiently. Accurate Accounting Enterprise 4 has been integrated with Account Payable module, General Ledger, Account Receivable and Inventory. Accurate Accounting Enterprise 4 has got Value Added Tax (VAT) for Account Payable module. You can also download Intuit Turbo Tax Premier 2017.

|

|

Top Digital Marketing Agencies In

9 times mentioned • Parker Chin • 30 November 2023

Top Digital Marketing Agencies In

|

Top Digital Marketing Agencies in KL Malaysia. Top Leading SEO & Digital Marketing Agency. We focus on offering tailored digital marketing solutions such as SEO, SEM, Digital Marketing Strategy, and Planning. We're committed to further expanding to cover every facet of online marketing in the near future. Our ultimate goal is to become a full-service online marketing and branding solution provider that assists clients to achieve their online goals with the power of technology.

|

|

Everyone can have their own blog websites now. People use Invaber to blog their life, post their wishlists, post their preferences, share with others on Google. You also can discover more on what you blog. Invaber is sponsored by Microsoft.

|

|

Join Invaber |

|

|

What is Invaber? |

|

Lastest Business

|

|